There has been much discussion over recent years over the success (or lack thereof) of joint ventures between mainstream construction and services business and Traditional Owner (TO) entities in the Western Australian Mining Sector. In my experience, the optimal approach to securing long-term sustainable business opportunities for the TO partner lies in a planned Transitional Approach to the venture that results in a long-term transition of skills, capital and capability to the TO partner.

Such an approach relies on a number of key factors:

• A desire on the part of the TO partner to develop their business capabilities;

• A willingness on the part of the Non-Indigenous partner to develop the TO partner over the long-term and essentially walk away from the venture at the end of the agreed transitional period; and

• A client (mining company) that supports the arrangement and, in some cases, holds both parties to account.

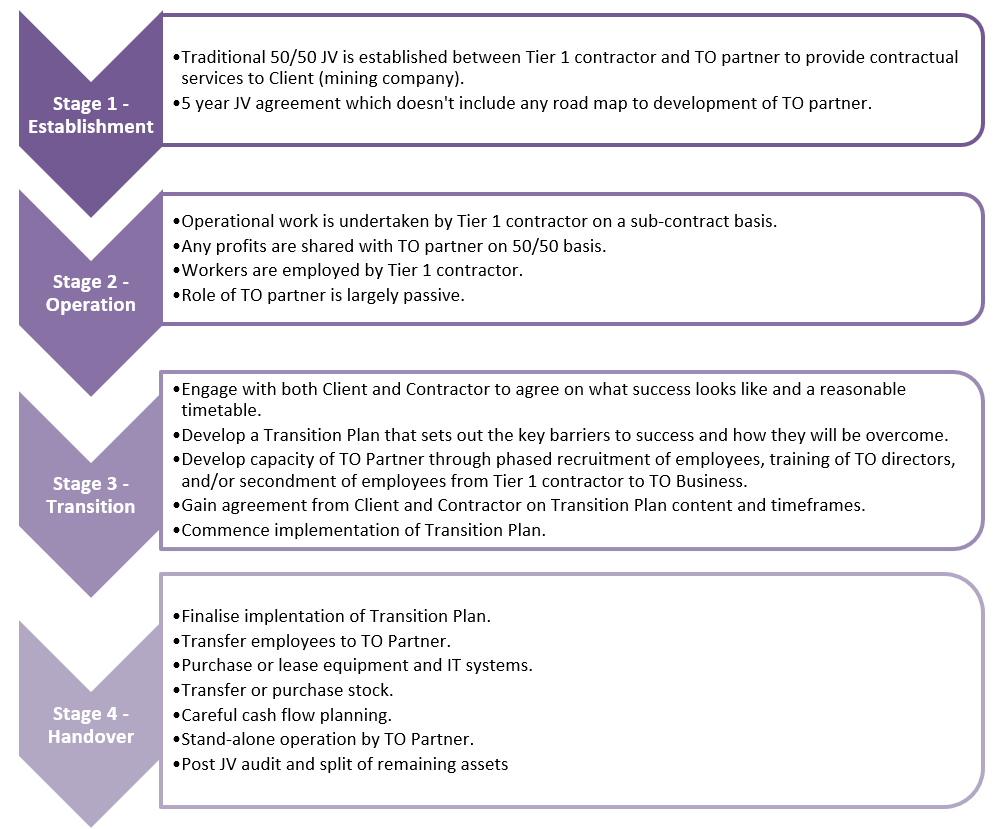

The main steps to establishing such Transitional Joint-Ventures between Tier 1 contractors and TO entities are set out below.

I’ve worked on a number of such joint venture projects in the past where Keogh Bay has seen (and facilitated) such an approach to successfully deliver a successful outcome. An excellent example would be the joint venture between Traditional Owner business Triodia Mining and MacMahons Contracting at the Anglo-Gold Ashanti Tropicana Gold mining project in the WA Goldfields. This JV originally involved a 50/50 agreement between the two parties where most of the capacity, employment and operational activity was undertaken by the senior partner but where, over a number of years, the JV transitioned to a conclusion where Triodia Tropicana Pty Ltd took over the sole operation of the Light Vehicle Workshop at the mine. An excellent outcome that has resulted in significant training and employment opportunities for local Aboriginal people.

Jonathan Price

Keogh Bay Director

Contact Jonathan Price on 0423765437 or by email to jonathan.price@keoghbay.com.au